Crypto Market Maker

Description as a Tweet:

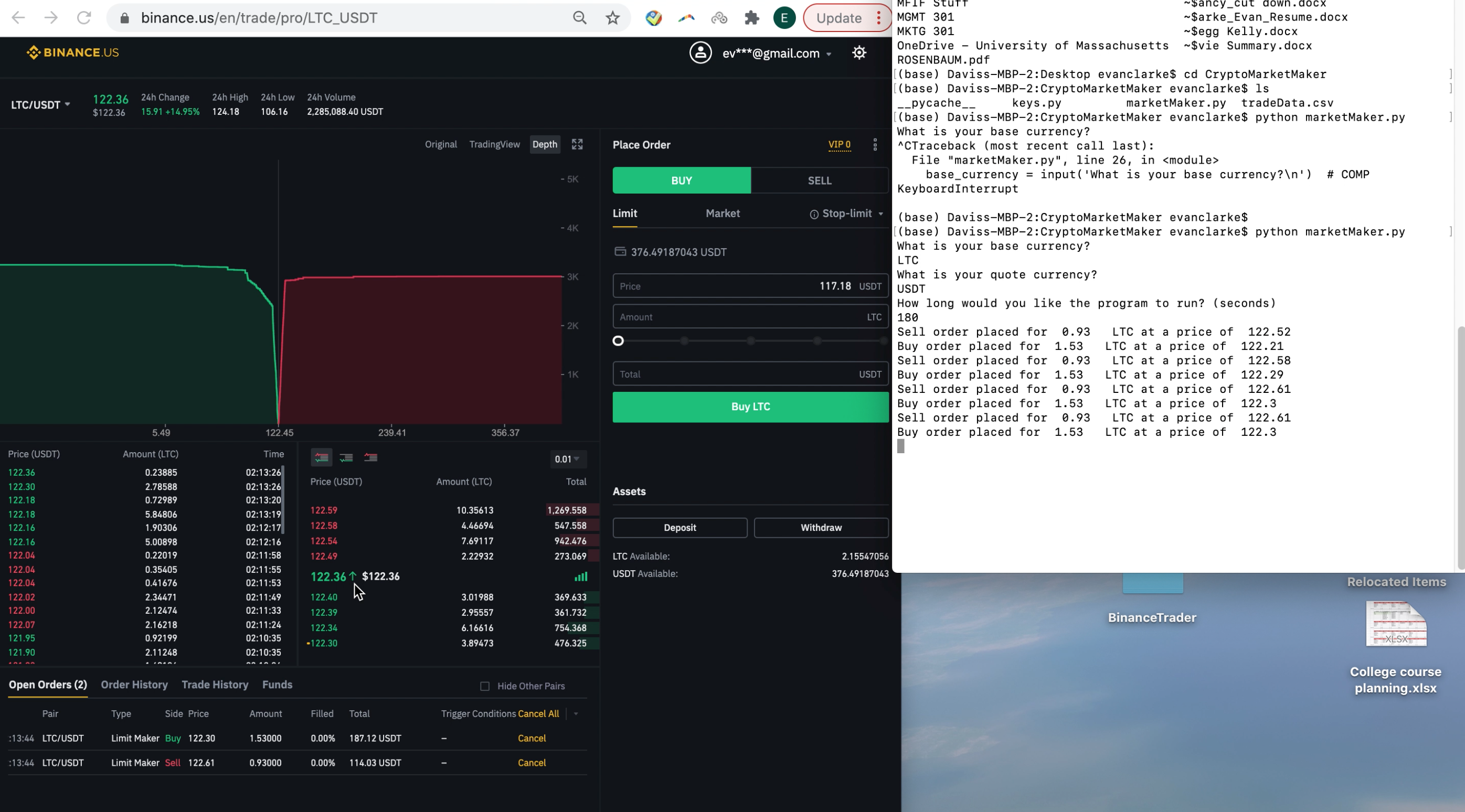

It provides liquidity to cryptocurrency markets by systematically placing bid and offer orders. It dynamically alters order size to control risk, and adjusts the prices based on market conditions and a risk parameter.

Inspiration:

I have been starting to learn Python and went to the HackUMass events covering the language. I wanted to practice using the language while also applying it to something that interests me. I have been reading about automated trading, and decided I wanted to try my hand at it.

What it does:

The user determines the market in which they want to trade and for how long and the project then utilizes Binance API to automatically place both a bid and ask limit order near the market price. It updates these every five seconds in accordance with shifting portfolio balance, elapsed time, and market conditions. At the end it compiles the completed trades into a .csv file so the data can be analyzed.

How we built it:

Pycharm was used as an IDE and it is written in Python. Pandas is used for compiling and exporting trade data.

Technologies we used:

- Python

- Misc

Challenges we ran into:

Developing strategies to handle inventory risk was difficult, since most coins do not have a futures market and interest rates for margin trading are steep. As a result I designed it so the base portfolio allocation would be 50% cash 50% crypto. Inventory risk is present, but this solution makes it measurable and more predictable.

Accomplishments we're proud of:

It executed over $15,000 in trades over a 3-hour time frame when I ran it.

What we've learned:

I was able to gain a better understanding of Python, especially dictionaries and variable scopes. Additionally, I learned about automated trading and cryptocurrencies.

What's next:

Continuing to tweak the pricing and inventory strategies, and developing a way to further provide liquidity by simultaneously accessing multiple different exchanges.

Built with:

Pycharm

Prizes we're going for:

- Best Finance Hack